Why trust us?

Most financial advisers receive a commission and/or charge an asset based fee on the financial products they recommend.

Link Advice is different. Link Advice is a fee for Service Company. Therefore, Advisers charge on a fee for service basis and do not accept commissions from product providers. We do not manufacture our own products - which means we do not make a profit on the financial products we recommend. Instead, we partner with quality industry super and retail funds to recommend you solid investment products.

So when we make a recommendation, you know it's because we believe it will enhance your financial position - not ours.

How we can help you?

Money Coaching

Simple, fast and affordable advice delivered to you over the telephone.

Here are some of the common questions our advisers answer:

- Which investment option should I choose in super?

- Should I salary sacrifice?

- How much insurance do I need?

- What are my retirement options?

When we provide personal financial advice over the phone, we will also send you a written Statement of Advice (SoA). Our financial advice is clear and easy to understand so you feel confident it's right for you.

Financial Planning

Financial Planning advice is more comprehensive advice about super and non-super assets delivered to you face to face.

Here are some of the common questions our advisers answer:

- What should I do with my super at retirement?

- How do I arrange my finances to live comfortably in retirement?

- How long will my money last in retirement?

- I want to know my money is safe and secure...

- How do I maximise my Age Pension?

- How do I minimise tax at retirement?

The first meeting is free. It gives you an opportunity to get to know us and decide if our services are right for you.

We also offer an Ongoing Care Program to help you stay on track to enjoy the lifestyle you want in retirement.

How much will it cost?

Link Advice charges a flat fee for service based on the time involved. Our fee may be paid for by your super fund; or, may be deducted from your super account so that you can maintain your cash flow. Your adviser will let you know if a fee applies prior to commencing any work.

We pride ourselves on being trustworthy and transparent in how we charge for our services.

Engage and retain your Super Fund Members for life through a trusted partnership with Link Advice.

We offer a wide range of advice services which can be tailored specifically to your Fund’s advice strategy.

How we can help you?

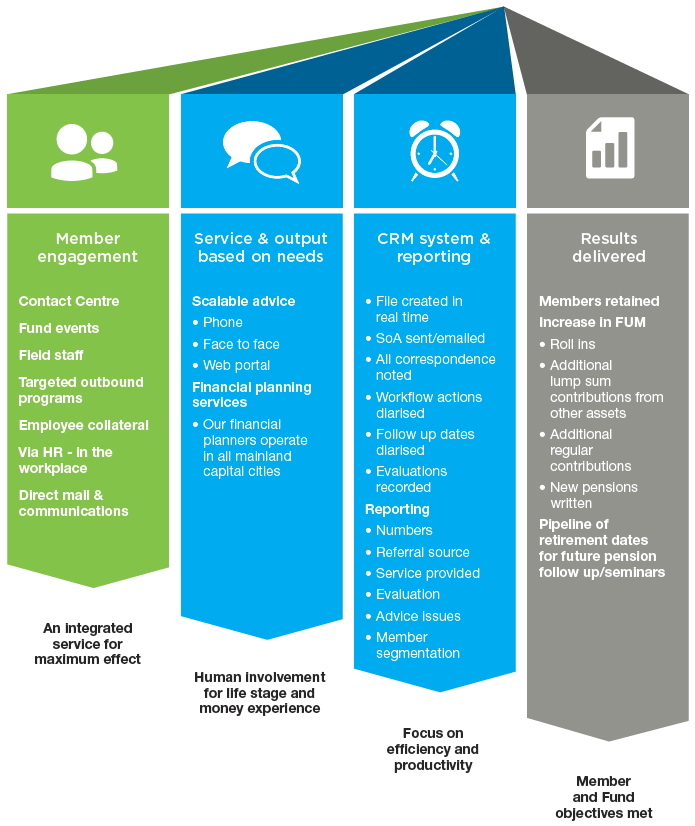

Our flexible advice model is designed to seamlessly integrate into your key member touch points. You can tailor our model to deliver to your strategic plan and service model.

Benefits for your Fund

Link Advice will help you enhance your Fund's service offering, improve brand recognition, grow funds under management and increase member retention by providing:

Our engagement model

Control and manage your advice service in-house through a trusted partnership with Link Advice.

We offer a wide range of dealer services which can be tailored specifically to your Fund's advice strategy.

How we can help you?

Our suite of dealer services will empower a Fund to deliver on its strategic plan and operating model. Here is a summary of our services:

| Type of Advice | Delivery | Link Advice Solutions |

|---|---|---|

| General advice |

|

|

| Online tools & calculators |

|

|

| Intra-fund advice and Scaled advice |

|

|

| Financial Planning |

|

|

Benefits for your Fund

- Seamless member experience across all your member touchpoints

- Drive member engagement to strengthen the relationship with members

- Retain members for life

- Grow funds under management

- Increase new pensions

- Activate existing members to take positive action on their account

- Acquire new members

- Enhance and protect your Fund's brand

- Help members to navigate confidently through changing legislation

Want to know more?

For more information on our services click here.

Send us a message through the 'Contact' tab at the top of this page website or call us on 1300 734 007 8am to 6pm (EST) Monday to Friday.